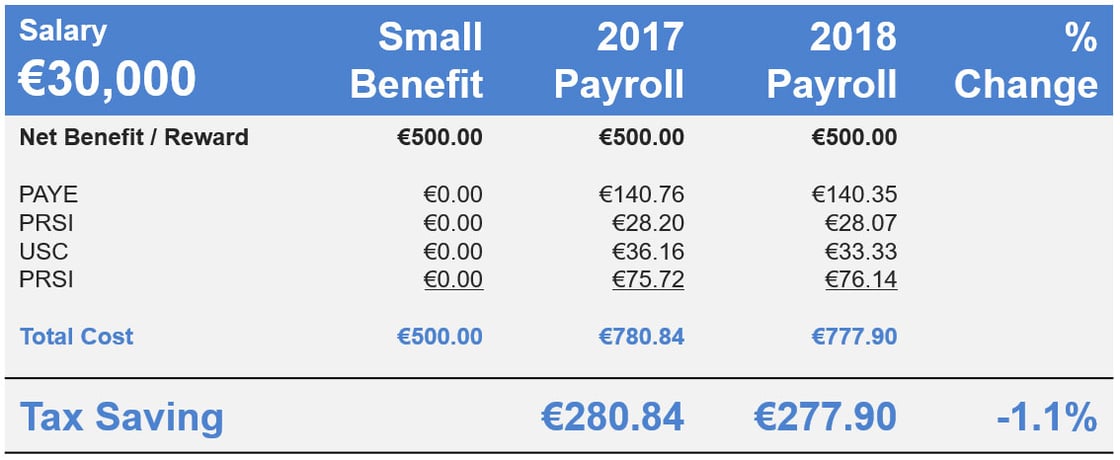

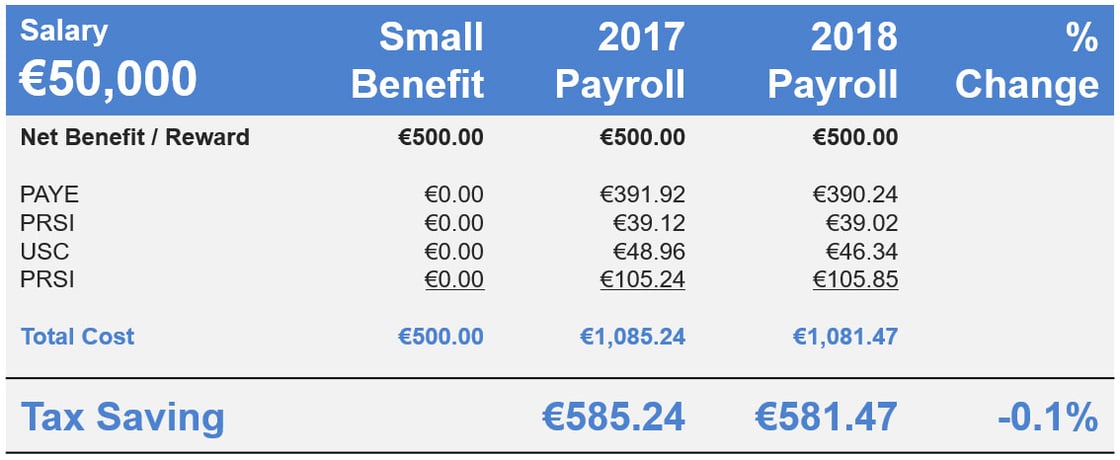

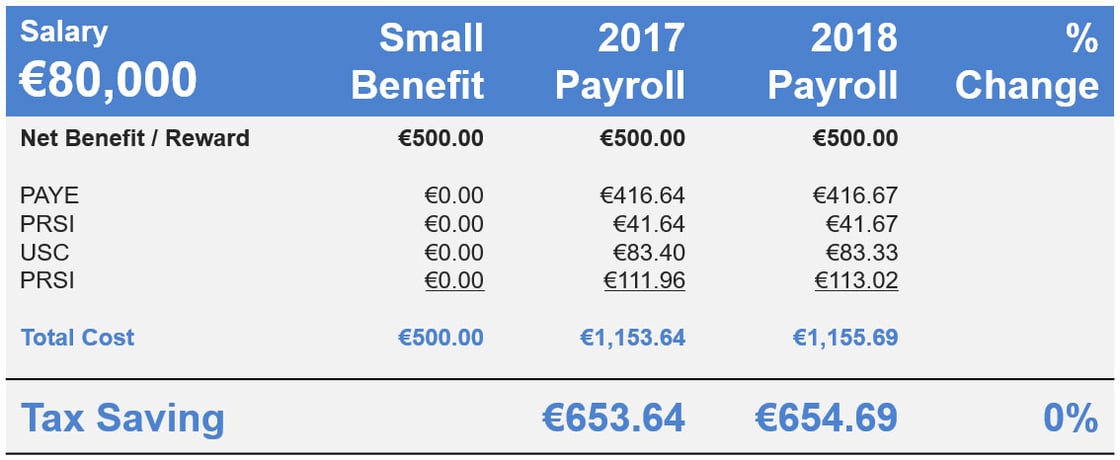

As expected, Budget 2018 saw no change to the €500 Small Benefit Scheme (SBS). With a 0.5% National Training Fund Levy being added to employer PRSI and modest improvements in employee tax credits, tax bands and USC rates, below is the updated tax saving calculations for Small Benefit in 2018.

The above examples are based on single employees with gross salaries of €30k, €50k, and €80k per annum.

About the Small Benefit Scheme

The SBS is a statutory tax relief scheme offered by Irish Revenue that allows employers to provide a tax exempt benefit or reward to Irish employees of up to €500 per year without any tax liability.

That means that the employer saves the 10.85% employer PRSI that they would otherwise be liable for if the reward was put through payroll. The employee saves on all USC, PRSI and PAYE at their marginal rate.

To avail of the scheme, 4 key rules need to be adhered to. Allgo provides companies with a range of reward products and services that are approved for the Small Benefit Scheme.

For more about the Small Benefit Scheme, download our definitive guide -